7 Smart Investment Benefits of Home Buying in Carson City Real Estate

If you're considering home buying in Carson City real estate, you're on the right track. Purchasing a home is not just about having a place to live, it’s a strategic investment that can build wealth, provide stability, and enhance your quality of life. At Lisa Williams – The A Team, we help buyers make confident decisions by showing them the long-term advantages of homeownership.

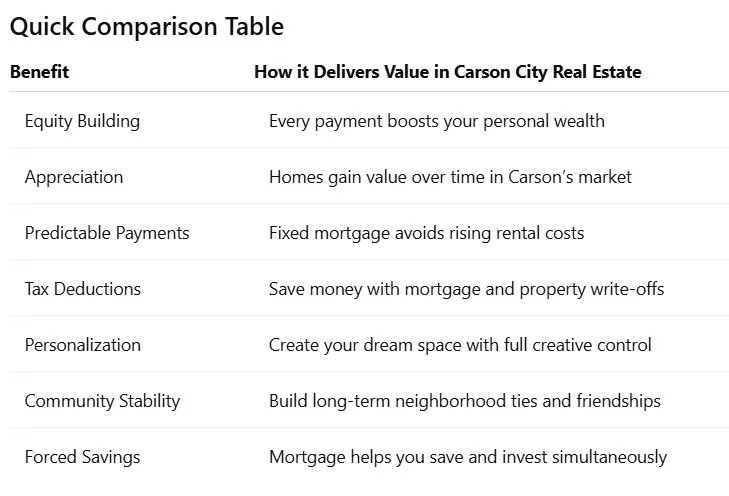

In this guide, we’ll explore seven compelling reasons why buying a home in Carson City is one of the smartest investments you can make.

Why Home Buying in Carson City Real Estate Makes Sense

Carson City’s real estate market has experienced steady appreciation, making it a solid option for both first-time buyers and seasoned investors. With historically low interest rates, growing home values, and a welcoming community atmosphere, purchasing a home here gives you access to both personal and financial rewards.

Instead of paying rent month after month with no return, homeownership allows you to build equity and gain value from your monthly payments. You also enjoy freedom, predictability, and tax advantages that renting can’t match.

1. Build Equity & Wealth Over Time

As a homeowner, each mortgage payment you make adds to your equity, the portion of the home you truly own. Instead of throwing away money on rent, you're investing in a property that gains value over time. This equity can be tapped into later through refinancing or used as leverage for future investments.

Over the years, real estate has proven to be a powerful tool for wealth-building. It’s a tangible asset that increases your net worth as property values rise.

2. Home Values Appreciate

While the market may experience temporary dips, the long-term trend for real estate is upward. Carson City real estate, in particular, benefits from low housing inventory, desirable lifestyle, and continuous growth—all of which drive appreciation.

Buying now locks in today’s value and positions you for gains in the future.

3. Predictable Monthly Housing Costs

Unlike renting, where your landlord can raise prices each year, homeownership offers predictability. With a fixed-rate mortgage, your monthly principal and interest remain stable for the life of the loan. That means no surprises—and better budgeting.

Even if property taxes or insurance shift slightly, you’ll avoid the unpredictable rent hikes renters often face.

4. Tax Advantages of Homeownership

Owning a home opens up valuable tax benefits:

Deduct mortgage interest

Deduct property taxes

Exclude capital gains from the sale of your primary residence (in many cases)

These tax perks can amount to thousands in annual savings—money that stays in your pocket rather than going to Uncle Sam.

5. Freedom to Customize Your Home

As a homeowner, you have the freedom to personalize your space without permission from a landlord. Paint walls, remodel the kitchen, install solar panels, create a backyard oasis, your home, your rules.

Customization not only enhances your lifestyle but can also add value to your home if done smartly.

6. Community & Lifestyle Benefits

Owning a home often leads to stronger community ties. Homeowners tend to stay in one place longer, leading to better relationships with neighbors, involvement in local events, and greater stability.

In Carson City, with its vibrant downtown, outdoor lifestyle, and welcoming vibe, owning a home lets you truly become part of the community. It’s also a place to create memories, raise a family, and enjoy long-term peace of mind.

7. Forced Savings & Long-Term Security

Every payment you make on your mortgage is a contribution to your future. Unlike renting, where money disappears every month, mortgage payments increase your home equity.

This “forced savings” plan is a powerful way to grow your assets over time and build financial security for retirement, emergencies, or future plans.

Real-Life Perspective: More Than Just Dollars

Beyond financial benefits, owning a home offers emotional rewards. There’s pride in owning a place that’s truly yours, peace of mind from having long-term stability, and joy in customizing a space that reflects your personality.

For families, the consistency of owning a home means uninterrupted schooling, stable routines, and safe environments—all factors that contribute to better well-being and performance.

What to Prepare For as a Homeowner

While the benefits are great, homeownership also comes with responsibilities:

Upfront costs (down payment, closing costs)

Regular maintenance and repairs

Market fluctuations

However, with expert guidance from Lisa Williams – The A Team, we’ll help you navigate all these challenges and make smart, informed decisions from day one.

Frequently Asked Questions

Q1. Why buy instead of rent?

Buying allows you to build equity, gain appreciation, and benefit from tax savings. Rent payments offer no return and can increase year over year.

Q2. Do you get more money back for buying a house?

Yes. Over time, homeownership builds equity and may lead to appreciation. You can also benefit from tax deductions and eventual resale profits.

Q3. What is the biggest obstacle to homeownership?

The most common challenges are saving for a down payment, qualifying for a mortgage, and understanding closing costs. Working with an experienced team like ours helps overcome these hurdles.

Q4. At what income should you buy a house?

There’s no one-size-fits-all number, but many experts recommend your monthly housing costs not exceed 30% of your gross income. We’ll help evaluate what’s affordable for your unique situation.

Q5. Is buying a home the best way to build wealth?

It’s one of the most proven methods. Real estate builds equity and appreciates in value, often outpacing inflation and offering long-term financial stability.

Q6. Is home buying in Carson City real estate worth it?

Absolutely. Carson City's market offers stability, growth, and a lifestyle that makes long-term ownership a smart move.

Q7. How much do I need to buy a home in Carson City?

Minimums vary, but many buyers can get started with as little as 3% down. Loan programs and first-time buyer assistance are also available.

Q8. Are there tax benefits to owning a home?

Yes—mortgage interest, property taxes, and capital gains exclusions can all save you money.

Q9. Is it better to rent or buy in today’s market?

If you plan to stay 3–5 years or more, buying often leads to greater financial and lifestyle benefits over time.

Q10. What if I’m not ready for a big down payment?

Talk to us—we can help you explore programs that reduce upfront costs and find financing options that suit your situation.

Conclusion

Buying a home in Carson City real estate is more than just a transaction, it’s an investment in your future. From financial growth to personal freedom, the advantages of homeownership are powerful and lasting. If you're ready to explore your options, Lisa Williams – The A Team is here to help you every step of the way.

End Note

If you're thinking about home buying in Carson City real estate, Lisa Williams – The A Team is your go-to expert. We help clients find homes that fit their budget, goals, and lifestyle, all while making smart, informed decisions along the way. From the first showing to the final signature, we’re here to guide you with honesty, experience, and unmatched local insight. Contact us today and let’s turn your dream of homeownership into reality.